Reasons for and Implications from Innovation Moving to Consumers

Reasons for and Implications from Innovation Moving to Consumers

Today, the headlines and buzz for information technologies centers on smartphones, social networks, cloud computing, tablets and everything Internet. Very little is now discussed about IT in the enterprise. This declining trend began about 15 years ago, and has been accelerating over time. Letting the air out of the enterprise IT balloon has some profound reasons and implications. It also has some lessons and guidance related to semantic approaches and technologies and their adoption by enterprises.

A Brief Look at Sixty Years of Enterprise IT

One can probably clock the start of enterprise information technology (IT) to the first use of mainframe computers in the early 1950s [1], or sixty years ago. The earliest mainframes were huge and expensive machines that required their own specially air-conditioned rooms because of the heat they generated. The first use of “information technology” as a term occurred in a Harvard Business Review article from 1958 [2].

Until the late 1960s computers were usually supplied under lease, and were not purchased [3]. Service and all software were generally bundled into the lease amount without separate charge and with source code provided. Then, in 1969, IBM led an industry change by starting to charge separately for (mainframe) software and services, and ceasing to supply source code [3]. At about the same time integrated circuits enabled computer sizes to be reduced, with the minicomputers such as from DEC causing a marked expansion in number of potential customers. Enterprise apps became a huge business, with software licensing and maintenance fees achieving a peak of 70% of IT vendor total revenues by the mid-1990s [4]. However, since that peak, enterprise software as a portion of vendor revenues has been steadily eroding.

One of the earliest enterprise applications was in transaction systems and their underlying database management software. The relational database management system (RDBMS) was initially developed at IBM. Oracle, based on early work for the CIA in the late 1970s and its innovation to write in the C programming language, was able to port the RDBMS to multiple operating systems. These efforts, along with those of other notable vendors (most of which like Informix no longer exist), led to the RDBMS becoming more or less the de facto standard for data management within the enterprise by the 1980s. Today Oracle is the largest supplier of RDBMS software globally, and other earlier database system designs such as network databases or object databases fell out of favor [5].

In 1975, the Altair 8800 was introduced to electronics hobbyists as the first microcomputer, followed then by Apple II and the IBM PC in 1981, among others. Rapidly a slew of new applications became available to the individual, including spreadsheets, small databases, graphics programs and word processors. These apps were a boon to individual productivity and the IBM PC in particular brought credibility and acceptance within the enterprise (along with the growth of Microsoft). Novell and local area networks also pointed the way to a more distributed computing future. By the late 1980s virtually every knowledge worker within enterprises had some degree of computer literacy.

The apogee for enterprise software and apps occurred in the 1990s, with whole classes of new applications (most denoted by three-letter acronyms) such as enterprise resource planning (ERP), business intelligence (BI), customer relationship management (CRM), enterprise information systems (EIS) and the like coming to the fore. These systems also began as proprietary software, which resulted in the “stovepiping” or creating of information silos. In reaction and with great market acceptance, vendors such as SAP arose to provide comprehensive, enterprise-wide solutions, though often at high cost and with significant failure rates.

More significantly, the 1990s also saw the innovation of the World Wide Web with its basis in hypertext links on the Internet. Greatly facilitated by the Mosaic Web browser, the basis of the commercial Netscape browser, and the HTML markup language and HTTP transport protocol, millions began experiencing the benefit of creating Web pages and interconnecting. By the mid-1990s, enterprises were on the Web in force, bringing with them larger content volumes, dynamic databases and enterprise portals. The ability for anyone to become a publisher led to a focus and attention on the new medium that led to still further innovations in e-commerce and online advertising. New languages and uses of Web pages and applications emerged, creating a convergence of design, media, content and interactivity. Venture capital and new startups with valuations independent of revenues led to a frenzy of hype and eventually the dot com crash of 2000.

The growth companies of the past 15 years have not had the traditional focus on enterprises, but on the use and development of the Web. From search (Google) to social interactions (Facebook) to media and video (Flickr, YouTube) and to information (Wikipedia), the engines of growth have shifted away from the enterprise.

Meanwhile, the challenges of data integration and interoperability that were such a keen focus going back to initial enterprise computerization remain. Now, however, these challenges are even greater, as we see images, documents (unstructured data) and Web pages, markup and metadata (semi-structured data) become first-class information citizens. What was a challenge in integrating structured data in the 1980s and 1990s via data warehousing, has now become positively daunting for the enterprise with respect to scale and scope.

The paradox is that as these enterprise needs increased, the attractiveness of the enterprise from an IT perspective has greatly decreased. It is these factors we discuss below, with an eye to how Web architecture, design and opportunities may offer a new path through the maze of enterprise information interoperability.

The Current Landscape

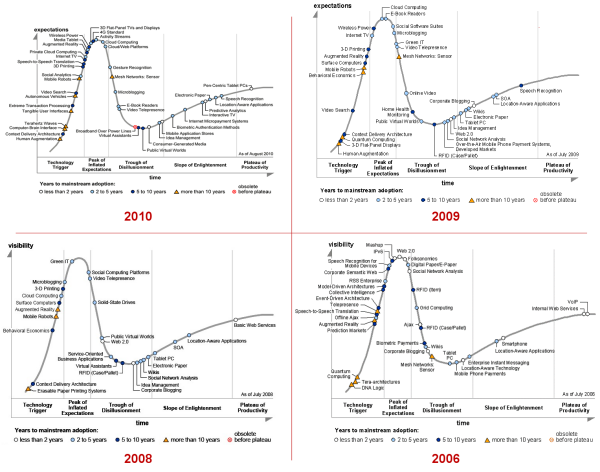

Since 1995 the Gartner Group has been producing its annual Hype Cycle [6]. The clientele for this research is the enterprise, so Gartner’s presentation of what’s hot and what’s hype and what is being adopted is a good proxy for the IT state of affairs in enterprises. These graphs are reproduced below since 2006 (click to expand). Note how many of the items shown are not very specific to the enterprise:

References to architectures and content processing and related topics were somewhat prevalent in 2006, but have disappeared most recently. In comparison to the innovations noted under the History discussion, it appears that the items on Gartner’s radar are more related to consumer applications and uses. We no longer see whole new categories of enterprise-related apps or enterprise architectures.

The kinds of innovations that are being discussed as important to enterprises in the coming year [7,8] tend to mostly leverage existing innovations in other areas or to wrinkle existing approaches. One report from Constellation Research, for example, lists the five core disruptive technologies of social, mobile, cloud, analytics and unified communications [7]. Only analytics could be described as enterprise focused or driven.

And, even in analytics, the kinds of things being promoted are self-service reporting or analysis [8]. In essence, these opportunities represent the application of Web 2.0 techniques to bring reporting or analysis directly to the analyst. Though important and long overdue, such innovations are more derivative than fundamental.

Master data management (MDM) is another touted area. But, to read analyst’s predictions in these areas, it feels like one has stepped into a time warp of technologies and options from a decade ago. When has XML felt like an innovation?

Of course, there is a whole industry of analysts that makes their living prognosticating to enterprises about what to expect from information technologies and how to adopt and embrace them. The general observations — across the board — seem to center on items such as smartphones and mobile, moving to the cloud for software or platforms (SaaS, PaaS), and collaboration and social networks. As I note below, there is nothing inherently wrong or unexciting per se about these trends. But, what does appear true is that the locus of innovation has shifted from the enterprise to consumers or the Internet.

Seven Reasons for a Shift in Innovation

The shift in innovation away from the enterprise has been structural, not cyclical. That means that very fundamental forces are at work to cause this change in innovation focus. It does not mean that innovation has permanently shifted away from the enterprise (organizations), but that some form of countervailing structural changes would need to occur to see a return to the IT focus on the enterprise from prior decades.

I think we can point to seven structural reasons for this shift, many of which interact with one another. While all of them are bringing benefits (some yet to be foreseen) to the enterprise, and therefore are to be lauded, they are not strictly geared to address specific enterprise challenges.

#1: The Internet

As pundits say, “The Internet changes everything” [9]. For the reasons noted under the history above, the most important cause for the shift in innovation away from the enterprise has been the Internet.

One aspect that is quite interesting is the use of Internet-based technologies to provide “outsourced” enterprise applications hosted on Web servers. Such “cloud computing” leverages the technologies and protocols inherent to the Internet. It shifts hosting, maintenance and upgrade responsibilities for conventional apps to remote providers. Initially, of course, this simply shifts locus and responsibility from in-house to a virtual party. But, it is also the case that such changes will also promote more subtle shifts in collaboration and interaction possibilities. There is also the fact that quick upgrades of underlying infrastructure and application software can also occur.

The implications for existing enterprise IT staff, traditional providers, and licensing and maintenance approaches are profound. The Internet and cloud computing will perhaps have a greater effect on governance, staffing and management than application functionality per se.

#2: Consumer Innovations

The captivating IT-related innovations at present are mobile (smartphones) and their apps, tablets and e-book readers, Internet TV and video, and social networks of a variety of stripes. Somewhat like the phenomenon of when personal computers first appeared, many of these consumer innovations have applicability to the enterprise, though only as a side effect.

It is perhaps instructive to look back at the adoption of PCs in the enterprise to understand the possible effect of these new consumer innovations. Central IT was never able to control and manage the proliferation of personal computers, and only began to understand years later what benefits and new governance challenges they brought. Enterprise leaders will understand how to embrace and extend today’s new consumer technologies for the enterprise’s benefits; laggards will resist to no avail.

The ubiquity of computing will be enormously impactful on the enterprise. The understanding of what makes sense to do on a mobile basis with a small screen and what belongs on the desk or in the office is merely a glimmer in the current conversation. However, in the end, like most of the other innovations noted in this analysis, the enterprise will largely be a reactive player to these innovations. Yes, the implications will be profound, but their inherent basis are not grounded in unique enterprise challenges. Nonetheless, adapting to them and changing business practice will be critical to asserting enterprise leadership.

#3: Open Source

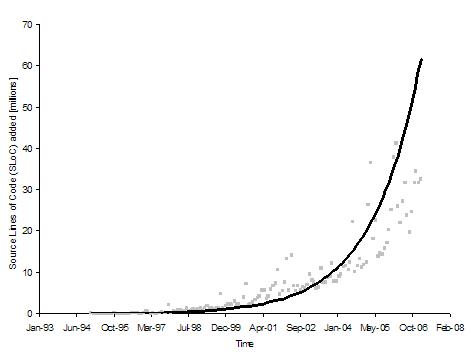

Ten years ago open source was largely dismissed in the enterprise. About five years ago VCs and others began funding new commercial open source ventures, even while there were still rear guard arguments from enterprises resisting open source. Meanwhile, as the figure to the right shows, open source projects were growing exponentially [10].

The shift to open source in the enterprise, still ongoing, has been rapid. Within 5 years, more than 50% of enterprise software will be open source [11] . According to an article in Fortune magazine last year [12], a Forrester Research survey found that 48% of enterprise respondents were using open source operating systems, and 57% were using open source code. A similar Accenture survey of 300 large public and private companies found that half are committed to open source software, with 38% saying they would begin using open-source software for “mission-critical” applications over the next 12 months.

There are likely many reasons for this shift, including the Internet itself and its basis in open source. Many of the most successful companies of the past 15 years including Amazon, Google, Facebook, and virtually any large Web site has shown excellent performance and scalability building their IT infrastructure around open source foundations. Most of the large, existing enterprise IT vendors, notably including IBM, Oracle, Nokia, Intel, Sun (prior to Oracle), Citrix, Novell (just acquired by Attachmate) and SAP have bought open source providers or have visible support for open source initiatives. Even two of the most vocal proprietary source proponents of the past — HP and Microsoft — have begun to make moves toward open source.

The age of proprietary software based on proprietary standards is dead. The monopoly rents formerly associated with unique, proprietary platforms and large-scale enterprise apps are over. Even where software remains proprietary, it is embracing open standards for data interchange and APIs. Traditional enterprise apps such as content management, business intelligence and ETL, among all others, are being penetrated by commercial open source offerings (as examples, Alfresco, Pentaho and Talend, respectively). The shift to services and new business models appears to be an inexorable force.

Declining profit margins, matched with the relatively high cost of marketing and sales to enterprises, means attention and focus have been shifting away from the enterprise. And with these shifts in focus has come a reduction in enterprise-focused innovation.

#4: Slow Development Cycles in Enterprise

It is not unusual to find deployed systems within enterprises as old as thirty years [13]. So long as they work reasonably well, systems once installed — along with their data — tend to remain in operation until their platforms or functionality become totally obsolete. This leads to rather lengthy turnover cycles, and slow development cycles.

Slow cycles in themselves slow innovation. But slow development cycles are also a disincentive to attract the most capable developers. When development tends to focus on maintenance and scripts and more routines of the same nature, the best developers tend to migrate elsewhere (see next).

Another aspect of slow development cycles is the imperative for new enterprise IT to relate to and accommodate legacy systems — again, including legacy data. This consideration is the source of one of the negative implications of a shift away from innovation in the enterprise: the orphaning of existing information assets.

#5: What’s Hot: Developers

Arguably the emphasis on consumer and Internet technologies means that is where the best developers gravitate. Developing apps for smartphones or working at one of the cool Internet companies or joining a passionate community of open source developers is now attracting the best developers. Open source and Web-based systems also lead to faster development cycles. The very best developers are often the founders of the next generation startups and Web and software companies [14].

While, of course, huge numbers of computer programmers and IT specialists are hired by enterprises each year, the motivations tend to be higher pay, better benefits and more job security. The nature of the work and the bureaucracy and routine of many IT functions require such compensation. And, because of the other shifts noted elsewhere, even the software startups that are able to attract the most innovative developers no longer tend to develop for enterprise purposes.

Computer science students have been declining in industrialized countries for some time and that is the category of slowest growth in IT [14]. Meanwhile, existing IT personnel often have expertise in older legacy systems or have been focused on bug fixes and more prosaic tasks like report writing. Narrow job descriptions and work activities also keep many existing IT personnel from getting exposed to or learning about new trends or innovations, such as the semantic Web.

Declining numbers of new talent, plus declining interest by that talent, combined with (often) narrow and legacy expertise of existing talent, creates a disappointing storm of energy and innovation to address enterprise IT challenges. Enterprises have it within their power to create more exciting career opportunities to overcome these limitations, but unfortunately IT management often also appears challenged to get on top of these structural forces.

#6: What’s Hot: Startups

Open source and Internet-based systems have reduced the capital necessary for a new startup by an order of magnitude or so over the past decade. It is now quite possible to get a new startup up and running for tens to hundreds of thousands of dollars, as opposed to the millions of years past. This is leading to more startups, more startups per innovator, and quicker startup and abandonment cycles. Ideas can be tried quickly and more easily thrown away [15].

These dynamics are acting to accelerate overall development cycles and to cause a shift in funding structures and funding amounts by VCs and angels. The kind of market and sales development typical for many enterprise sales does not fit well within these dynamics and is a countervailing force for more capital when all trends point the other way.

In short, all of this is saying that money goes to where the returns are, and returns are not of the same basis as decades past in the enterprise sector. Again, this means a hollowing out of innovation for enterprises.

#7: Declining Software Rents and Consolidation

As an earlier reference noted [4], software revenues as a percent of IT vendor revenues peaked in about the mid-1990s. As profitability for these entities began to decline, so did the overall attractiveness of the sector.

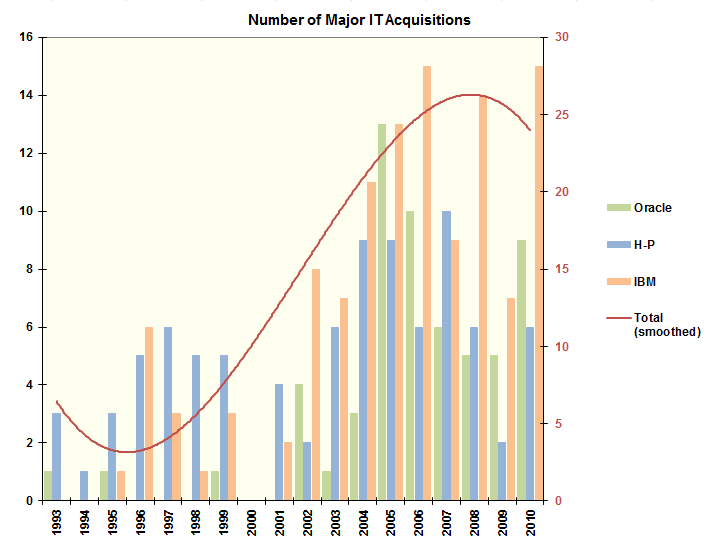

As the next chart shows, coincident with the peak in profitability was the onset of a consolidation trend in the enterprise IT vendor sector [16]. The chart below shows that three of the largest IT vendors today — Oracle, IBM and HP — began an acquisition spree in the mid-1990s that has continued until just recently, as many of the existing major players have already been acquired:

Notable acquisitions over this period include: Oracle — PeopleSoft, Siebel Systems, MySQL, Hyperion, BEA and Sun; HP — EDS, 3Com, VeriFone, Compaq, Palm and Mercury Interactive; IBM — Lotus, Rational, Informix, Ascential, FileNet, Cognos and SPSS. Published acquisition costs exceeded $130 billion, mostly for the larger deals. But terms for 75% of the 262 transactions were not disclosed [16]. The total value of these consolidations likely approaches $200 billion to $300 billion.

Clearly, the market is now favoring large players with large service components. This consolidation trend does belie one early criticism of open source v proprietary software: proprietary software is likely to be better supported. In theory this might be true, but vanishing suppliers does not bode well for support either. Over time, we may likely see successful open source projects showing greater longevity than many IT vendors.

Positive Implications from the Decline

This discussion is not a boo-hoo because the heyday of enterprise IT innovation is past. Much of that innovation was expensive, often failed to achieve successful adoption, and promoted walled gardens and silos. As someone who ran companies directly involved in enterprise software sales, I personally do not miss the meetings, the travel, the suits and the 18-month sales cycles.

The enterprise has gained much from outside innovation in the past, from the personal computer to LANs and browsers and the Internet. To be sure, what we are now seeing with mobile phones has more computing power than the original Space Shuttle [17], and continued mashup and social engagement innovations will have unforeseen and manifest benefits for enterprises. I think this is unalloyed goodness.

We can also see innovations based on the Internet such as the semantic Web and its languages and standards to promote interoperability. Breaking these barriers is critically needed by enterprises of the future. Data models such as RDF [18] and open world mindsets that better accommodate uncertainty and breadth of information [19] can only be seen as positive. The leverage that will come from these non-enterprise innovations may in the end prove to be as important as the enterprise-specific innovations of the past.

Negative Implications from the Decline

Yet a shift to Internet and consumer IT innovation leaves some implications. These concerns have to do with the unique demands and needs of enterprises. One negative implication is that a diminishing supplier base may not lead to actual deployments that are enterprise-ready or -responsive.

The first concern relates to quality and operational integrity. There is an immense gulf between ISO 9000 or Six Sigma and, for example, the “good enough” of standard search results on the Web. Consumer apps do not impose the same thresholds for quality as demanded by paying bosses or paying customers. This is not a value judgment; simply a reality. I see it reflected in the quality of tools and code for many new innovations today on the Web.

Proofs-of-concept and “cool” demos work well for academic theses or basic intros to new concepts. The 20% that gets you 80% goes a long way to point the way to new innovation; but the 80% to get to the last 20% is where enterprises bet their money. Unfortunately, in too many instances, that gap is not being filled. The last 20% is hard work, often boring, and certainly not as exciting as the next Big Thing. And, as the trends above try to explicate, there are also diminishing rewards for living in that territory.

A similar and second concern pervades data interoperability. Data interoperability has been the central challenge of enterprise IT for at least three decades. As soon as we were able to interconnect systems and bridge differences in operating systems and data schema, the Holy Grail has been breaking information barriers and silos. The initial attempts with proprietary data warehouses or enterprise-wide ERP systems were wrongly trying to apply closed solutions to inherently open problems. But, now, finally when we have the open approaches and standards in hand for bridging these gaps, the attractiveness of doing so for the enterprise seems to have vanished.

For example, we see demos, tools and algorithms being published all over the place that show promising advances or improvements in the semantic Web or linked data (among other areas; see [20]). Some of these automated techniques sound wonderful, but real systems require the hard slog of review and manual approval. Quality matters. If Technique A, say, shows an improvement over Technique B of 5%, that is worth touting. But even at 98% percent accuracy, we will still find 20,000 errors in a population of 1 million items. Such errors will simply not work in having trains run on time, seats be available on airplanes, or inventory get to their required destinations.

What can work from the standpoint of linkage or interoperability on the Web according to consumer standards will simply not fly for many enterprises. But, where are the rewards for tackling that hard slog?

Another concern is security and differential access. Open Web systems, bless their hearts, do not impose the same access and need to know restrictions as information systems within enterprises. If we are to adopt Web-based approaches to the next-generation enterprise — a position we strongly advocate — then we are also going to need to figure out how to marry these two world views. Again, there appears to be an effort-reward mismatch here.

What Lessons Might be Drawn?

These observations are not meant to be a polemic, but a statement of more-or-less current circumstances. Since its widescale adoption, the major challenge — and opportunity — of enterprise IT has been how to leverage the value within the enterprise’s existing digital information assets. That challenge is augmented today with the availability of literally a whole world of external digital knowledge. Yet, the energy and emphasis for innovation to address these challenges has seemingly shifted to consumers and away from the enterprise.

Economics abhors a vacuum. I think two responses may be likely to this circumstance. The first is that new vendors will emerge to address these gaps, but with different cost structures and business models. I’d like to think my own firm, Structured Dynamics, is one of these entities. How we are addressing this opportunity and differences in our business model we will discuss at a later time. In any case, any such new player will need to take account of some of the structural changes noted above.

Another response can come from enterprises themselves, using and working the same forces of change noted earlier. Via collaboration and open source, enterprises can band together to contribute resources, expertise and people to develop open source infrastructures and standards to address the challenges of interoperability. We already see exemplars of such responses in somewhat related areas via initiatives such as Eclipse, Apache, W3C, OASIS and others. By leveraging the same tools of collaboration and open data and systems and the Internet, enterprises can band together and ensure their own self-interests are being addressed.

One advantage of this open, collaborative approach is that it is consistent with the current innovation trends in IT. But the real advantage is that it works and is needed. Without it, it is unclear how the enterprise IT challenge — especially in data interoperability — will be met.

This is a great resource for IM professionals. We have a community for IM professionals (www.openmethodology.org) and have bookmarked this post for our users. Look forward to reading your work in the future.